Good day All,

Well this is not technical topic but wanted to help guys as it’s

this time of Year and we usually need to file our returns.

Note I am not a Charted Accountant, this is useful for guys who already paid their Taxes through your Employer and just have to file the returns.

Prerequisites before you start:

1.

PAN Number

2.

Form 16 and Form16A of Company

3.

Registered and Login details of Income-tax e-filing

website.

- Now let’s start Step-by-Step Process to file your returns

- 1. We have 2 ways to file returns either by downloading an Excel sheet or On-line Filing. I have done both but I think offline mode of Excel sheet is pretty simple, so this article I will go over Offline Mode.

- 2. Click on the below link and download ITR 1and extract the Excel sheet to a folder.

- https://incometaxindiaefiling.gov.in/e-Filing/Services/DownloadItrLink.html

- 3. You will see a file called 2015_ITR1_PR1.xls, open it. Please make sure to read the Read Me.txt file to enable Macros, this is very important

- 4. A pop will show-up, read it… it tells you that anything Red Labels are Mandatory.. see below and say ok

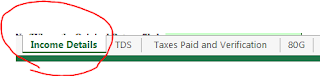

- 5. You start filling in the details in Income Details Sheet

- 6. As said Above anything Marked Red are Mandatory so start filling all the details as possible till Row 32

- 7. Row 41

1. INCOME FROM SALARY: Open your Form 16 1st line would be

your Gross Salary, look couple of rows below after your HRA and Standard

Deductions You will see something called “Income chargeable under the head

SALARIES(3-5)” , make a note so that will be your INCOME FROM SALARY

2.

Row 42 Income from One House Property: If you have Let out then mention it if not just leave it blank.

3.

Row 44 will be Auto Filled

4.

Row 46, 80c Maximum value is 1, 50,000.Open your

Form16 and add all the amounts under Section 80C and fill in the field.

5.

Row 47 to 63 if you have anything mentioned in

your Form 16 then fill the respective Fields.

6.

Row 65 Taxable Total Income is Auto Filled as

below

7.

Row 66 to 78 you don’t have to fill anything

just leave as it is

- 8. Now save your Excel sheet and Click on Validate as below

- 9. Sheet Income Details OK.If you see any error, a description will be present asking to correct it.

- 10. Click on TDS Tab Sheet and Fill Row which shows 19 TDS1, as seen below. TAN Number and Name of the Employer can be found in your Form 16A, Income under Salary would be same Salary you mentioned in Income Details Sheet ROW 41 and Tax Deducted would be amount mentioned under Tax payable in Form 16

Note: If you have mulitple Form 16, you need to put both the employers

- 11. Click Save the sheet and Click Validate to make sure Sheet is ok.

- 12. Now go to Taxes Paid and Verification tab and Fill Row 27. Make sure you mention the number of Savings Bank Account you hold and all his details as below

- 13. Now save your sheet and click Validate

- 14. Now Click on Sheet Income Details and Click Calculate Tax ,

- 15. It will take a moment to calculate Tax and now if you go at Row 25 Under Refund of Taxes paid and Verification Sheet you will see that it Auto calculated and Value show as Zero(0).

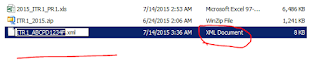

This was easy.. Click Generate XML and you will see xml generated in the same location as Excel sheet was opened.

The below is just to remind in case Calculate Tax was not done

Now login to Income tax e-filing webiste

Click the Submit button a confirmation mail with IRT-1 will be sent to your registered Email ID.

Open the IRT-1 PDF, just double check to make sure everything is ok and take a print and send to Banglore Address given in the same PDF.

Well this was easy, all you need to do is spend like 5 bucks for Stamp and like 30mints of your time :)

Income tax Slab:

Hope this helps someone... till next time have a good day!!!

Open the IRT-1 PDF, just double check to make sure everything is ok and take a print and send to Banglore Address given in the same PDF.

Well this was easy, all you need to do is spend like 5 bucks for Stamp and like 30mints of your time :)

Income tax Slab:

Hope this helps someone... till next time have a good day!!!

Thanks for the brilliant information regard income tax. I appreciate the author's work from bottom of my heart.

ReplyDeleteIncome Tax Return Filing